This article is part of a larger series on Payments.

TABLE OF CONTENTSEVO Payments is an international merchant services provider offering payment processing in 50 countries and 150+ currencies to over 550,000 merchants worldwide. It provides a wide range of solutions—such as credit card processing, omnichannel processing, B2B, mobile, and ecommerce payments.

In our ranking of merchant services providers, EVO Payments earned an overall score of 2.74 out of 5. Like most direct processors, it lacks pricing transparency. Additionally, a quick read of its disclosures indicates that it offers a tiered-pricing model and a hefty early termination fee. These top our list of reasons why we do not recommend EVO Payments to small businesses.

Since Our Last Update: On Aug. 1, 2022, Global Payments announced its acquisition of EVO Payments. Among other payment companies owned by Global Payments are TSYS and Heartland Payment Systems. However, the acquisition of EVO Payments has prompted several investigations into potential breaches of fiduciary duty and a lawsuit from a pension fund.

Looking for the lowest rates? The payment processing rates you will pay can vary based on your business size, type, and average order value. To find the most affordable option and compare multiple processing rates, read our guide on the cheapest credit card processing.

EVO Payments received low scores in this criteria because of the lack of pricing transparency, long-term contract, and high cancellation fee. Small businesses are better off with one of our recommended merchant service providers, which offers simple, transparent pricing, pay-as-you-go terms, and zero monthly fees.

Payment ProcessingThe glaring lack of transparency over its fees and pricing structure is a major concern for small businesses intending to sign up directly with EVO Payments. Since EVO Payments is a direct processor, rates are not advertised on its website, although you can find incidental fees mentioned in its terms of service:

You will also find the provider’s brief explanation of tiered-pricing on the disclosure page. Note that terms and fees will change if you sign up with an ISO.

Direct Processor vs ISO: Direct processors are payment companies that have direct access to the card networks, while independent sales organizations (ISO) are companies or organizations that are resellers of merchant account services being offered by direct processors.

EVO Payments also has its own in-house payments integration, EVO Snap*, which provides all-in-one omnichannel payment processing and application integrations. The use of EVO Snap* incurs a $10 monthly fee and the following processing fees:

EVO Payments offers different hardware solutions based on the type of software:

While it does not have proprietary hardware, EVO Payments’ mobile hardware of choice are popular brands that can be easily integrated into your payment system.

Note: EVO Payments also supports Dejavoo, Verifone, and Nexgo N5 terminals, which would all require programming to work with the EVO Payments software. Meanwhile, you can download EVO Payments’ mobile payment app for free and process transactions without a card reader; however, transaction rates are often higher than when you use a card reader device.

Contract & Terms of ServiceSigning up for a direct merchant account with EVO Payments carries a three-year contract with a one-year auto-renewal clause. Of course, you may receive a different set of terms if you sign up with one of its ISOs. Your business profile will naturally contribute to the terms and conditions and the fees that will be set in your merchant agreement. For mid- and large-sized businesses interested in an EVO Payments merchant account, please take note of the following stipulations in its terms of service:

It’s also important to ensure that you do not sign up for a tiered-pricing plan under any circumstances.

FILE TO DOWNLOAD OR INTEGRATE

Download as PDF

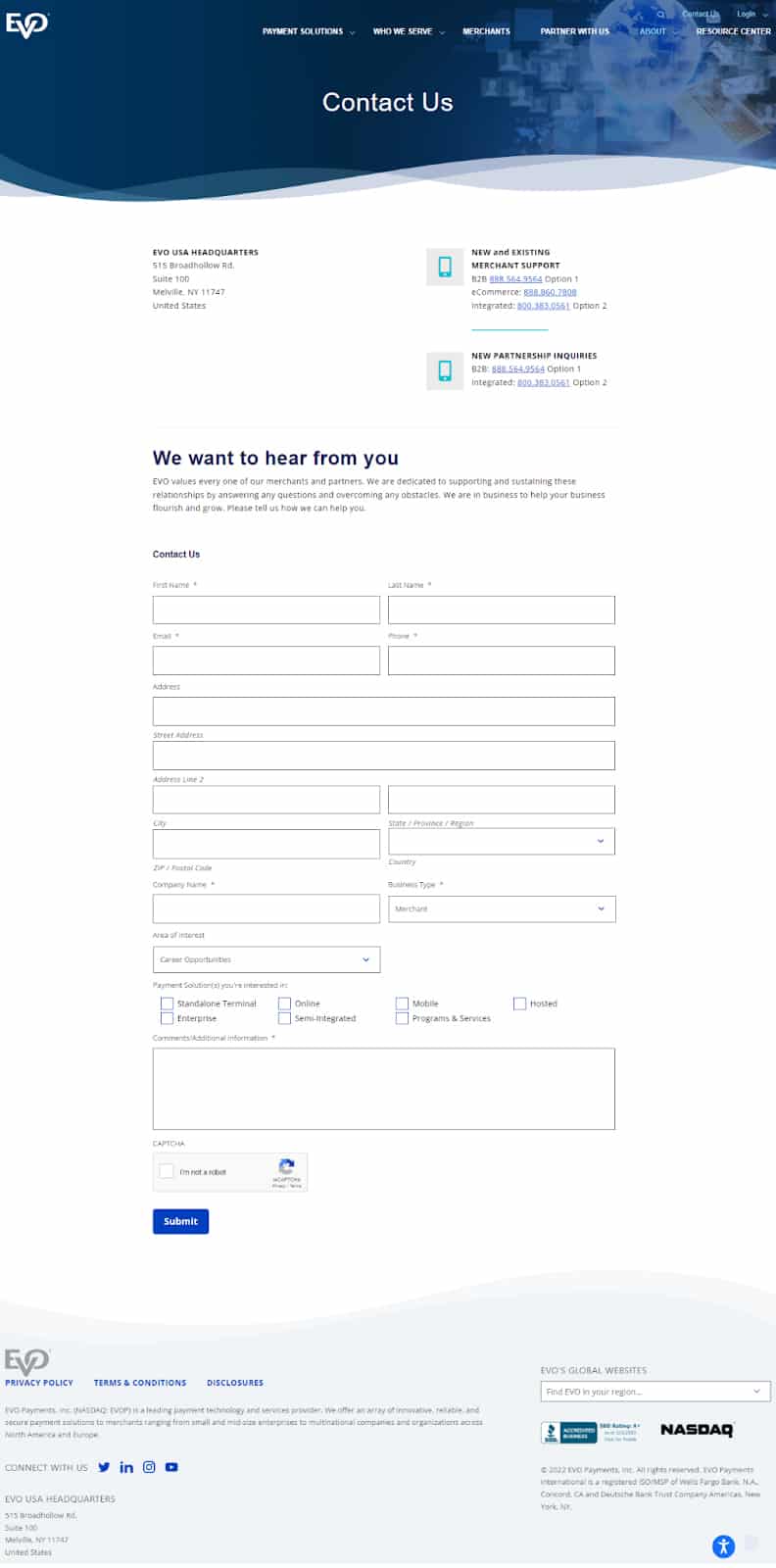

Applying for an EVO Payments merchant account starts by filling out an online form or giving the provider a call on the phone number on its website. There’s a different contact number for B2B businesses, which may mean merchants of this type are directed to certain resellers or maybe EVO sales representatives instead.

If you don’t feel like speaking on the phone, you can fill out an online form and a EVO Payments representative will get back to you within 24 hours. (Source: EVO Payments)

EVO Payments has flexible payment options, offering all the payment types we considered in our evaluation. However, most of them come with an additional monthly fee, increasing the fixed monthly costs even further if you want to utilize them. The exact add-on fees are also undisclosed and depend on individual merchant agreements. This caused EVO Payments to lose some points in this category.

Payment Gateways, Virtual Terminals, Hosted PaymentsThere are two payment gateway options available for EVO Payments merchants, and while they offer almost identical tools, the differences are in pricing and compatibility with certain platforms:

EVO DashboardThird-party gateways, such as Authorize.net and Datacap, are also available for seamless integration.

Mobile PaymentsEVO Mobile is EVO Payments’ complete mPOS solution. It works with mobile phones or tablet devices and can integrate with BBPOS chip readers. It has the ability to list and store products so merchants can easily add items to the shopping cart, swipe/dip/tap the customer’s credit card, and email the receipt. It also includes an inline tip feature so customers can add a dollar amount or percentage tip.

International Payment ProcessingEVO Payments allows you to accept payments across 50 countries and process over 150 currencies. Businesses that sell large, wholesale volumes of goods and services online and overseas may find EVO Payments’ B2B an ideal feature. It offers a number of payment gateway options that support Level 2 and 3 transactions and accounts receivable management.

EVO Payments earned higher scores for its instant deposits and 24/7 customer support. However, despite offering numerous integrations and tools, it lost a few points because of the additional fee that’s usually needed to utilize those tools.

EVO Snap* provides all-in-one omnichannel payment processing and application integrations. It offers hosted payment tools to create payment carts, donation pages, and online billing application forms.

Snap* Hosted Payments allows you to choose from basic URL redirection, embedded payment pages, social payment widgets, and secure payment links. Customization ranges from simple to highly customized designs for streamlining your customers’ checkout experience. It also allows integration of Snap*’s web-based payment and order storage platform with an existing website or ecommerce application.

Its Commerce Driver provides the ability to easily create EMV-approved iOS, Android, and Windows-based point-of-sale (POS) applications. It meets all EMV Level 3 compliance requirements.

EVO Snap*’s Commerce Web Services allows transactions across all acceptance points using the CWS Omni-Channel developer toolkit. Its omnichannel payment solutions include online, in-store, mobile, direct debit, contactless, and ACH payments. It also offers cardholder tokenization, subscription billing, data services, fraud prevention, and data protection. EVO Snap* also has its own ecommerce platform.

Express DepositsEVO Payments offers express deposit tools, which means you can request for funds to be deposited into your account and have access to it in 30 minutes. You can also customize the frequency of deposits from your EVO Payments dashboard. Note that only certain merchants are qualified to apply for this service.

Secure TechnologyLike other direct processors that have acquired the best payment security features, EVO Payments offers the latest tools to protect your customer’s credit card information. It implements security practices like point-to-point encryption (P2PE), tokenization, and network protection.

IntegrationsEVO Payments provides you with a huge list of software partners and third-party integration—from simple backend management tools to CRM and accounting platforms that work seamlessly with its payment processing software.

MyEVO Merchant PortalEVO Payments’ merchant portal gives merchants quick access to all transaction data. It also allows users to generate downloadable reports that can be used with popular accounting software applications and platforms.

Customer SupportCustomer service for existing merchants is available 24/7 through the following numbers:

While there’s a resource center page, the website lacks a knowledge base to help you manage simple technical issues.

The two major things that lowered our score for EVO Payments in this category are pricing and customer reviews. Like many large, traditional merchant service providers, EVO’s rates are likely designed for resellers or ISOs that can handle tiered pricing. Direct processors like EVO Payments are represented by a long list of ISOs that pass on these fees to merchants in flat or interchange-plus rates. This is one of the reasons pricing is not entirely advertised by direct processors on their websites.

So, while EVO Payments does work directly with small businesses, the rates you will receive will depend on whether you are in contact with an EVO sales representative or a reseller. Aside from pricing, there are poor EVO credit card processing reviews online about overcharging, which is a significant concern for small businesses.

Based on our evaluation, small business owners will find more value in other providers that require no monthly fees, offer omnichannel payment solutions, and have easily available upfront pricing information. Stripe or Square are two options we recommend.

User reviews are heavily mixed, with UK merchants giving EVO Payments an above-average score, while international users are not as pleased. Customer service quality comprises the largest percentage of complaints, but users who like the platform (though not many) commended it for its payment integration options.

It also earned a low 1.06 out of 5 stars on the Better Business Bureau and has received around 15 complaints this 2023. International—including US—users are unanimous with their EVO Payments feedback:

| Users Like | Users Don’t Like |

|---|---|

| Payment integration options | Overcharging |

| Invoicing software tools | Poor after-sales customer service |

| Confusing reports setup |

No doubt EVO Payments has grown into one of the largest direct processors with a wide range of merchant services features. However, based on our evaluation, we don’t recommend EVO Payments to small businesses mainly because of its inconsistent and undisclosed pricing, long-term contracts, and unfortunate user feedback. Small businesses would be better served with merchant service providers that offer competitive and transparent pricing.

Andrea is a retail expert writer at Fit Small Business, contributing to the payments section. Before joining Fit Small Business, she was an actuarial specialist and freelance writer. She also has experience helping online businesses with order and payment processing. Andrea has more than 11 years of experience writing online content on various topics ranging from marketing to business.